Being in business involves doing a multitude of jobs that no one person can do. From handling clients, keeping things even, and planning for expansion, financial judgment often takes a backseat. This is where outside assistance comes in useful; it is something that is required. But being able to … [Read more...] about What is a Remote CPA and How Can They Help Business Operations?

business tips

Sharp Looks, Smooth Operations: How to Choose Housekeeping Uniforms

If you’re in the hospitality industry, you know that how your housekeeping team looks can say a lot about your standards. Being dressed in a well-chosen uniform will make your staff look professional and coordinated, and guests will feel confident they’re in good hands. It’s a simple yet effective … [Read more...] about Sharp Looks, Smooth Operations: How to Choose Housekeeping Uniforms

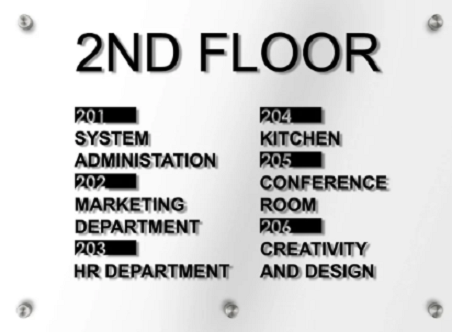

Floor Directory Signage That Elevates Every Space

In contemporary business settings, straightforward navigation is crucial. No matter if you manage a multi-story office, hotel, clinic, or retail space, using professionally crafted floor directory signage improves the overall experience for your visitors At Bsign, we emphasise crafting directional … [Read more...] about Floor Directory Signage That Elevates Every Space

The Art of Creating Bespoke Promotions for High-End Customers

Standing out in a saturated market takes more than just quality products. If your business caters to premium clients, you already know that a discount alone won’t sway them. High-end customers look for thoughtful, tailored experiences that reflect their status and expectations. They’re not buying … [Read more...] about The Art of Creating Bespoke Promotions for High-End Customers

Why Safe, Durable Blinds Matter in Commercial Settings

Blinds in commercial spaces do far more than control light. They contribute to comfort, protect privacy, and influence safety. From healthcare facilities to schools, the right choice of window coverings affects how people interact with the space. When these blinds are poorly made or not properly … [Read more...] about Why Safe, Durable Blinds Matter in Commercial Settings

Not Convinced About Ad Retargeting? 9 Facts and Statistics to Note

In the bustling digital landscape, advertisers are continually seeking innovative methods to capture the elusive attention of their target audience. One such strategy that has gained significant traction is ad retargeting, a tactic that involves displaying ads to users who have previously interacted … [Read more...] about Not Convinced About Ad Retargeting? 9 Facts and Statistics to Note

Proactive Steps Nonprofits Can Take to Prepare for an Audit

Preparing for a nonprofit audit requires careful planning, clear communication, and robust internal processes. Organizations must maintain organized records, understand audit requirements, involve all relevant personnel, and regularly review internal controls. Leveraging technology, monitoring … [Read more...] about Proactive Steps Nonprofits Can Take to Prepare for an Audit

Top 10 Corporate Event Venues for Your Next Function

IntroductionAre you planning your next corporate event and need the perfect event space for venue hire? Picking the right event space can make your gathering stand out. It can help create an unforgettable experience, whether you are hosting a gala dinner or a networking event. These days, there are … [Read more...] about Top 10 Corporate Event Venues for Your Next Function